Top 7 american depositary receipt in 2023

Below are the best information and knowledge on the subject american depositary receipt compiled and compiled by our own team laodongdongnai:

Nội Dung Chính

1. Understanding American Depositary Receipts (ADRs): Types, Pricing, Fees, Taxes

Author: www.investopedia.com

Date Submitted: 06/18/2020 05:40 AM

Average star voting: 3 ⭐ ( 31770 reviews)

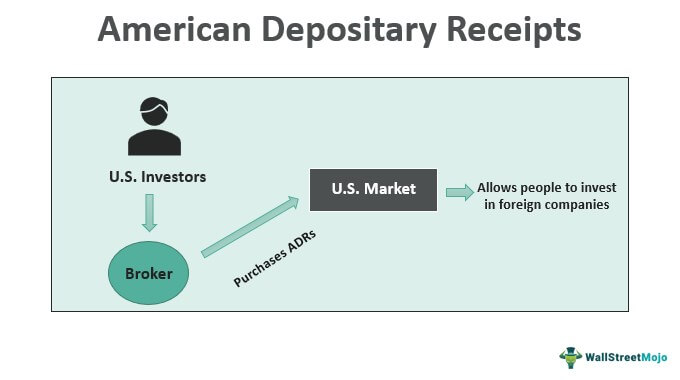

Summary: An American depositary receipt (ADR) is a U.S. bank-issued certificate representing shares in a foreign company for trade on American stock exchanges.

Match with the search results: An American depositary receipt (ADR) is a U.S. bank-issued certificate representing shares in a foreign company for trade on American stock exchanges….. read more

:max_bytes(150000):strip_icc()/TermDefinitions_adr-corrected-a2a478f27584412994f7fe6f1bca18fc.jpg)

2. American Depositary Receipts (ADRs) | Investor.gov

Author: www.fidelity.com

Date Submitted: 11/08/2020 09:08 AM

Average star voting: 5 ⭐ ( 16120 reviews)

Summary: The stocks of most foreign companies that trade in the U.S. markets are traded as American Depositary Receipts (ADRs). U.S. depositary banks issue these stocks. Each ADR represents one or more shares of foreign stock or a fraction of a share. If you own an ADR, you have the right to obtain the foreign stock it represents, but U.S. investors usually find it more convenient to own the ADR. The price of an ADR corresponds to the price of the foreign stock in its home market, adjusted to the ratio of the ADRs to foreign company shares.

Match with the search results: An American depositary receipt is a negotiable security that represents securities of a foreign company and allows that company’s shares to trade in the U.S. financial markets….. read more

3. US OGE

Author: www.sec.gov

Date Submitted: 02/17/2021 11:52 PM

Average star voting: 5 ⭐ ( 94843 reviews)

Summary:

Match with the search results: American depositary receipt (Dictionary definition)…. read more

4. American Depositary Receipts (ADR)

Author: en.wikipedia.org

Date Submitted: 08/28/2020 01:08 PM

Average star voting: 4 ⭐ ( 19825 reviews)

Summary: Guide to American Depositary Receipts (ADRs). We discuss the American Depositary Receipts (ADRs) types, examples, and advantages.

Match with the search results: An ADR is issued by an American bank or broker. It represents one or more shares of foreign-company stock held by that bank in the home stock market of the ……. read more

5. American Depositary Receipts: Your ticket to investing in overseas companies without the cost and complexity of foreign transactions

Author: www.investor.gov

Date Submitted: 04/19/2019 03:58 AM

Average star voting: 5 ⭐ ( 42629 reviews)

Summary: American Depositary Receipts, or ADRs, represent shares of foreign companies that Americans can buy and sell just like they do US stocks.

Match with the search results: An ADR is a negotiable certificate that evidences an ownership interest in American Depositary Shares. (“ADSs”) which, in turn, represent an interest in the ……. read more

6. American Depositary Receipts

Author: www.oge.gov

Date Submitted: 04/28/2020 05:51 PM

Average star voting: 5 ⭐ ( 91339 reviews)

Summary:

Match with the search results: An American depositary receipt is a negotiable security that represents securities of a foreign company and allows that company’s shares to trade in the ……. read more

7. What Are American Depositary Receipts?

Author: corporatefinanceinstitute.com

Date Submitted: 07/21/2022 02:40 PM

Average star voting: 5 ⭐ ( 67157 reviews)

Summary: ADRs represent shares of stock in foreign companies that don’t trade directly on U.S. exchanges. Learn how they work, along with their pros and cons.

Match with the search results: Each ADR represents one or more shares of foreign stock or a fraction of a share. If you own an ADR, you have the right to obtain the foreign stock it ……. read more

:max_bytes(150000):strip_icc()/GettyImages-149260741-23b10c042a8e42e98d74e197ac4eac46.jpg)