How to Sell on Amazon FBA in Canada

Learn how you can start an Amazon FBA Business from Canada and enjoy the benefits of the US Marketplace with our short guide.

Amazon is possibly the most innovative place to start selling if you want to get into e-commerce. With a massive marketplace, there are endless opportunities if you can find the right market. Many sellers worldwide wish to start selling here but aren’t sure how. If you are based in Canada, it’s not too hard! Follow our guide to start now.

The 6 Things You Need To Know To Sell on Amazon Canada

You can succeed on Amazon from anywhere in the world – though it is much easier if you live in North America. Canadian Amazon sellers face a few challenges, though the process is not complicated overall.

The actual process of setting up your store is almost the same in Canada as it is in the US.

There are just a few extra things to consider.

Amazon.com is the United States version of the site. This is where Americans shop. It’s also the largest and most competitive marketplace that Amazon has. Customers purchase thousands of items here daily, and the number of sellers online is impressive. Amazon.ca is the Canadian marketplace. It is less active and has less competition. Even if you’re based in Canada, you want to place your listings on the American marketplace to get max profits.

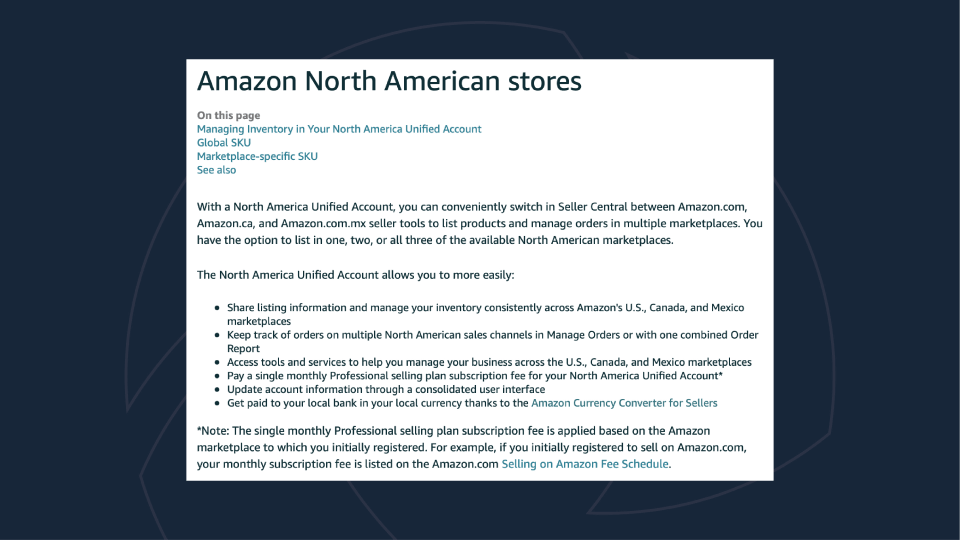

- How To Use A North America Unified Account

When you sign up for an Amazon Account, you will do so through the Amazon.ca website (you’ll save money this way, the Canadian fee is lower than the US fee). However, you can still access the US marketplace using a North American Unified Account. This Amazon seller account allows you to share listings with the American .com website, the Canadian .ca site, and the Mexican .com.mx site. You will sign up as a seller on Amazon.ca and then enjoy the benefits of Amazon.com as a unified account.

- How To Formalize Your Business

Before you get started on Amazon, you need to formalize your business. In the States, FBA owners typically choose an LLC. You could go through the hassle of forming a business within the US – but the wisest choice would be to form a corporation in Canada and list those details in your professional seller account. One thing you will need from the US is an EIN. You can get this by filing form SS-4 with the IRS or simply calling and applying over the phone.

- Dealing With US/Canadian Taxes

The US and Canada have a tax treaty in place. Because of this, you will likely not have to pay federal or state taxes to the United States if incorporated in Canada. This will change if you decide to move to the US and perform your business operations in or from America. But as long as your business is operated from Canada with no physical storefront, you should be in the clear.

You will have to pay all taxes in Canada for your Canadian seller account as you would for any other business. The one American tax you are responsible for is sales tax. Sales tax differs by state and is only required in states where you reach the “sales tax nexus.” Luckily, Amazon is now responsible for collecting and remitting sales taxes to most states, though you are still responsible for filing the appropriate forms. You can use a service like TaxJar, Avalara, or Sovos to simplify this process.

Always consult a tax professional familiar with your industry before making any final decisions in this department. We do not provide professional tax or financial advice – get the most up-to-date information from an American and a Canadian accountant familiar with cross-country e-commerce business dealings.

- How To Access Your Profits

The last big hurdle you will face as a Canadian Amazon seller working in the US marketplace is accessing your funds. This has gotten much easier since Amazon made its Currency Conversion program available, allowing you to access funds in your own currency (more on rates here).

If you find better exchange rates elsewhere and don’t want to go directly through Amazon, you can do so with cross-border banking with an institution like RBC Bank, TD Canada Trust, CIBC, or another Canadian bank account. The mentioned local bank account allows you to open a USD account and Canadian dollars account at the same time and easily toggle between them. You can also transfer funds between these two accounts at the conversion rate available on their site.

Banks can, at times, have high conversion rates. You may want to use a service like TransferWise to handle currency changes. This service allows you to put money in one currency and take it out in another. It is less official than cross-border banking but can sometimes be cheaper. Pick a service that works best for your business.

- Dealing With Warehouses

If you sell products on the US Marketplace, you need to house your products in a US-based warehouse. Most Amazon FBA sellers are ordering products from overseas anyways – so this shouldn’t be any more complicated for you than it is for sellers based in the US. You will simply communicate with your supplier which warehouse you would like products shipped to and ensure they send any samples to your location in Canada first.

Building Your FBA Business

Apart from these details, the process of building an Amazon FBA Store is roughly the same as it would be for any American seller.

You’ll perform quality market and product research, formalize your business structure, create an Amazon Seller Central Account, build and optimize your listings, and continue to scale as you grow.

It’s already complicated to run an Amazon marketplace store online as an American since you’re working with foreign suppliers and shipping products across the country. Also, the shipping costs involved. Add another country to that, and things can get complicated.

Make sure that you:

- Organize Everything. You are possibly dealing with business interactions between 3-5 countries, depending on where your suppliers are located. So keep detailed and highly organized records of everything. You can’t afford not to.

- Communicate Effectively. Cross-cultural communication can be challenging. Make sure you understand how to best communicate with any business partners, suppliers, or customers in cultures other than yours.

- Consult the Pros. Consult a legal and accounting team to ensure you’re operating your Amazon business 100% above board.

- Automate Everything. Where you can, automate. This includes sales taxes, inventory management, your own brand, Amazon brand registry, and product pricing – anything that can be automated should be. You may want to wait until you’re established before introducing automation, but it will help you once you feel comfortable doing so.

Conclusion

Selling on Amazon FBA in Canada is definitely possible and can be a lucrative endeavor. Just make sure you have your ducks in a row before getting started to avoid any complications down the road! Do you have any questions about selling on Amazon FBA in Canada? Let us know in the comments below!

Learn How To Build A Profitable Amazon Store

Stop putting off having your own profitable, thriving business backed by Amazon’s rapidly growing platform! Have our experts launch your store right alongside you.