Apple services revenue now 20% of all sales, and that’s before these 3 major 2023 fintech plays

Apple-services-revenue-has-grown-from-8-to-20-in-past-decade-Bloomberg-via-The-Basis-Point

This post originally appeared on The Basis Point: Apple services revenue now 20% of all sales, and that’s before these 3 major 2023 fintech plays

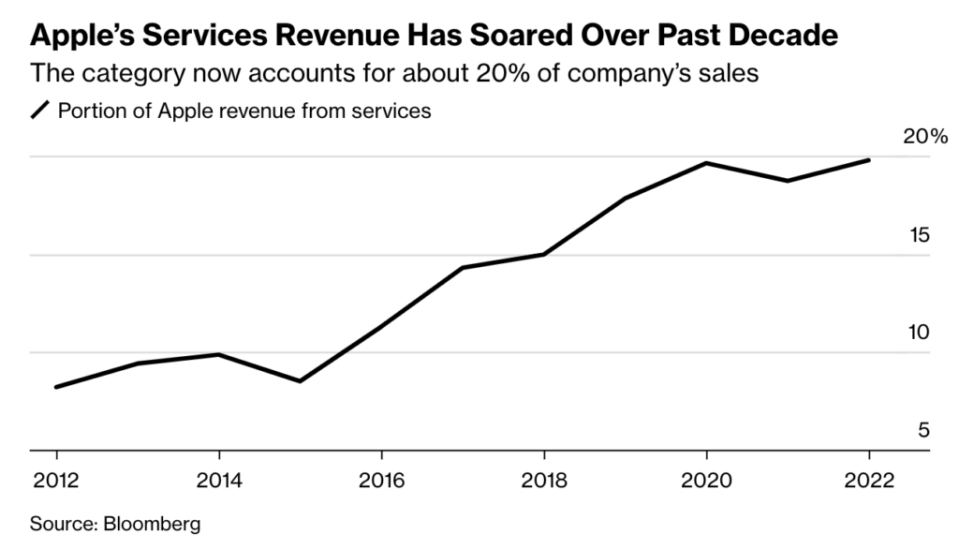

As Apple expands further into fintech with their new savings account, Bloomberg reports that 8.2% of Apple sales came from services in 2012, which grew to 19.8% in 2022. The savings account is Apple’s second major fintech move of 2023. Apple Pay Later was the first, and that product will expand into a third credit card-like initiative imminently. Here’s a recap, and a theory why Apple is the only Big Tech winning mainstream trust in consumer banking.

– This month, Apple goes deeper into fintech with their new high-yield savings account that claims to pay interest that’s 10x the average paid by banks right now.

– Apple savings, powered by Goldman Sachs for U.S. users and limited to deposit caps of $250k per customer, has no fees and no minimum balances.

– All you have to do is set it up in your Apple Wallet.

– Once Apple shows users their slick UX where they can see their budgeting, saving, and spending, you can imagine how this will grow.

– They already have practice showing users this kind of UX on spending with Apple Card, and the savings account is a service extension to Apple Card users.

– It’ll make Apple Card stickier even though, for now, there’s ostensibly no revenue attached to savings — because there are no fees to consumers.

– Last month, Apple launched Apple Pay Later, which lets people make purchases as low as $50 and up to $1000 then pay in installments.

– This is also ostensibly a low revenue endeavor because there’s no interest if you pay within the 6 week payback period.

– It was more of a beautiful Apple user experience that’s right on millions of phones for people already used to paying with Apple Pay.

– I must say I’ve gotten addicted to Apple Pay’s ease and rarely carry a wallet or credit card anymore.

– When Apple Pay Later launched, we noted 3 ways Apple Pay Later would eat Buy Now Pay Later competitors.

– In that piece, we asked 2 key questions:

– 1. How is BNPL not a credit card?

– 2. Why would small-dollar Apple Pay Later users not just use debit or credit if they have to repay in 6 weeks anyway?

– Bloomberg helps answer those questions, saying Apple is planning “an expanded version of the Pay Later program called Apple Pay Monthly Installments that can handle larger transactions over longer periods — while charging interest.”

– So, like, a credit card. But Apple style.

– And ostensibly not powered by Goldman Sachs so Apple’s services revenue would grow even more.

– And perhaps more important: it’s just so easy and cool for consumers.

– Buy Now Pay Later was always headed toward credit card like behavior and economics — from consumer user and regulatory expectations standpoints. Apple, like they often do, just cleaned up the business model and user experience.

– Final Note: I attribute Apple’s success in fintech and consumer banking not just to superior UX. It’s also a result of their steadfast commitment to privacy. They’re arguably the only Big Tech firm that’s truly honored privacy, and this is EVERYTHING in winning trust with people’s money.

___

Reference:

– Apple, Goldman Sachs Debut Savings Account With 4.15% Annual Yield

@byline

DO YOU LIKE MONEY? GET MORE AT THE BASIS POINT®

Google CEO says its ‘Don’t Be Evil’ mantra is ‘more nuanced’ now with AI

Key stats & quotes from 1Q23 Wells Fargo, JP Morgan, Citigroup earnings

Musk’s AI firm totally won’t threaten humanity and fuel political misinformation, right?