Abbott: Closing The Gap On Industry Leader (NYSE:ABT)

Sundry Photography/iStock Editorial via Getty Images

In our previous analysis of Abbott Laboratories (NYSE:ABT), we focused on the Diabetes, Nutritionals, and Cardiovascular business. We identified Abbott to be the market leader in the continuous glucose monitoring market with a 53% market share and forecasted the diabetes business to grow at 17.24% CAGR. Furthermore, we analyzed the ROA for each of the company’s segments and identified the Nutritionals business to have historically generated consistent returns regardless of economic conditions. We forecasted the Nutritionals segment to grow at a CAGR of 8.6% supported by increased awareness on the importance of nutrition and expected higher consumer spending on nutritional products. Additionally, we highlighted the 100+ products in development which are expected to be released in the next 3 years. Overall, we had obtained a target price of $121.05, which is in line with Abbot’s current price.

In this analysis, we looked into the company’s strength of its diversified revenue base that is derived from many countries across the globe. We look to identify the reasons that made this diversification possible and to determine if this is one of the key reasons for it having the second-highest market share within the Healthcare Equipment industry. We analyzed Abbott’s largest segment (Medical Devices) which primarily caters to the cardiovascular market to determine the growth opportunity in this area. We looked into the newly approved FDA products in the segment and identified their advantages compared to competitors and determined the market sizes for these products. Lastly, we looked into the company’s new venture within the neurology market with NeuroSphere Virtual Clinic in 2021. We looked into the specific competitive advantages of this new venture and the entire Neurology segment of Abbott, relative to its competitors within this market to determine its potential market share leadership. While these developments may seem promising, Abbott’s infant formula powder was recently recalled by the FDA following consumer complaints of bacterial infections after consuming the product.

Nội Dung Chính

Geographically Diverse Revenues Helped Become a Top Player in the Industry

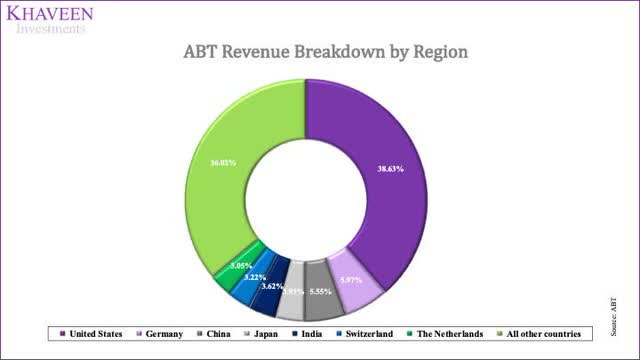

Abbott’s revenues are derived from a diverse set of countries. As shown in the revenue breakdown chart below, 38.63% of its revenues are from the US while the remaining 61.37% is derived from across the globe. The other key markets of Abbott besides the US are Germany, China, Japan, India, Switzerland, and The Netherlands.

Abbott

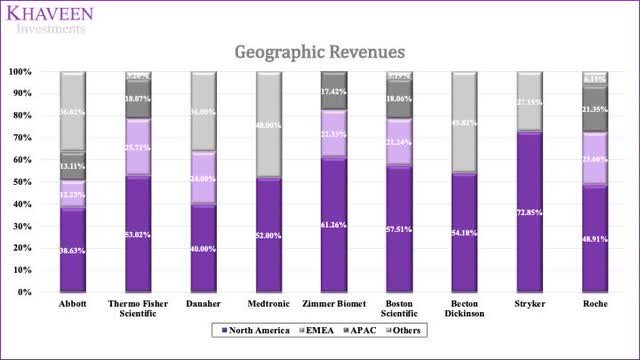

We compared Abbott’s geographic revenue breakdown against its competitors to identify competitive advantages that Abbott might have as a result of diversifying its revenues.

Company Annual Reports

In comparison to its competitors, Abbott has the most diverse set of revenues. It also has the least reliance on the US while other companies have more revenues relying on the US. From the chart above we observe:

- The top 5 companies by market share (Roche (OTCQX:RHHBY), Abbott, Thermo Fisher Scientific (TMO), Medtronic (MDT), and Danaher (DHR)) have diversified their revenues globally

- The North American region accounts for a significant portion of revenues for all companies, including Roche which is a Swiss-based company

- 61.37% of Abbott’s revenues are derived outside the North American region which is closely followed by Danaher at 60%. Apart from Danaher, all other companies identified in the chart derive almost half or less than half of their revenues from outside the North American region

We believe the diversification of revenues benefits Abbott as they are currently among the top 5 largest healthcare equipment manufacturers globally. While the diversification of revenues may have helped the company in placing itself among the top companies in the industry, we believe it does not differentiate itself from the top players.

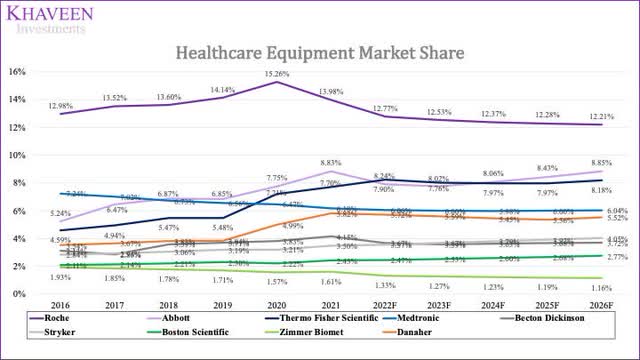

To further differentiate itself and compete against the top healthcare equipment manufacturers, Abbott acquired St. Jude Medical in 2017 for $25 bln which resulted in a 179.80% revenue growth for its cardiovascular business. Subsequently, we also see the company gained 1.24 percentage points market share from 2016 to 2017, cementing its position among the top 3 companies in the industry. In 2020 and 2021, Abbott further grew its market share to obtain the number 2 spot in terms of market share. The growth in market share in the past 2 years has been supported by the growth in its Diagnostics segment which grew at an average of 42.44%. This significant growth was due to demand for COVID-related products. We forecast Abbott’s market share against its competitors based on our revenue projections for each of the companies.

Company Annual Reports, Statista, Khaveen Investments

We believe the company’s market share could dip slightly in 2022 as we taper down COVID-related revenue. We tapered down Thermo Fisher Scientific’s COVID-related revenue slower than Abbott’s as they have contracts with vaccine manufacturers as well while Abbott does not. Hence, we expect to see a temporary swap in the market position of Abbott and Thermo Fisher Scientific as Abbott is expected to lose its COVID-related revenue faster than Thermo Fisher Scientific. Beyond COVID, we believe Abbott’s focus on high-growth products within the cardiovascular market may help it retain its number 2 spot as a global healthcare equipment manufacturer.

Focus on Fast-Growing Cardiovascular Markets

The company’s Cardiovascular business historical 5-year average revenue growth rate is 39.13% mainly supported by the acquisition of St Jude Medical in 2017. Through the acquisition, Abbott was able to enter the Rhythm Management and Heart Failure markets while also expanding its Electrophysiology, Vascular, and Structural Heart business within the cardiovascular market. Overall, the acquisition led to a 179.80% growth in revenues for the cardiovascular business of the company. The global cardiovascular market was valued at $54 bln in 2021 and forecasted to grow at a CAGR of 6.9% by Fortune Business Insights. Based on company announcements in the past year, we compiled products that have received regulatory approval specifically catering to the cardiovascular market.

New Devices Approved

Market Addressed

Type of Approval

CardioMEMS HF

Heart Failure

FDA Approval

EnSite™ X EP System with EnSite Omnipolar Technology

Cardiac Mapping

FDA Approval

Amulet Heart Device

Left Atrial Appendage

FDA Approval

Navitor

TAVR

CE Mark

Portico with FlexNav

TAVR

FDA Approval

Source: Abbott

Based on the table above, we see Abbott has received regulatory approval for 5 products in the past year specifically within the US which is the company’s largest market at 38.63%. For the CardioMEMS HF system, Abbott claims the newly approved system expands their addressable population by 1.2 mln people as the system can now be used for early detection of heart failure. Next, the cardiac mapping system is a new system for the company launched to treat abnormal heart rhythms. The system creates 3D maps of a patient’s heart to help doctors identify the origin points of the abnormal heart rhythms. The Amulet Heart Device is designed to close the Left Atrial Appendage (LAA) in patients to prevent clotting and stroke in patients. Lakkireddy et al. conducted a study with 1,878 patients to compare Abbott’s product with Boston Scientific’s product with the results of the study shown below. The inferiority margin is the statistical measure used to determine if a new treatment is better or worse than an already existing treatment. Inferior means the already existing treatment performs better than the new treatment, noninferior means there is no significant difference +between the two treatments, and superior means the new treatment is better than the already existing treatment. In our case, Abbott’s Amulet is the new treatment product while Boston Scientific’s Watchman product is the existing treatment in the market. Lakkireddy et al. concluded the study by stating:

The Amulet occluder was noninferior for safety and effectiveness of stroke prevention for nonvalvular atrial fibrillation compared with the Watchman device and superior for LAA occlusion. Procedure-related complications were higher with the Amulet occluder and decreased with operator experience. – Lakkireddy et al.

Product Comparison

Abbott’s Amulet

Boston Scientific’s Watchman

Inferiority Margin

95% Confidence Interval

Primary Safety End Point

14.50%

14.70%

Noninferior

-3.42 to 3.13

Primary Effectiveness End Point

2.80%

2.80%

Noninferior

-1.55 to 1.55

Composite of Stroke, Systemic Embolism, or Cardiovascular/Unexplained Death

5.60%

7.70%

Noninferior

-4.45 to 0.21

Rate of Major Bleeding

11.6%

12.3%

Noninferior

-3.72 to 2.31

LAA Occlusion

98.90%

96.80%

Superior

0.41 to 3.66

Source: Lakkireddy et al.

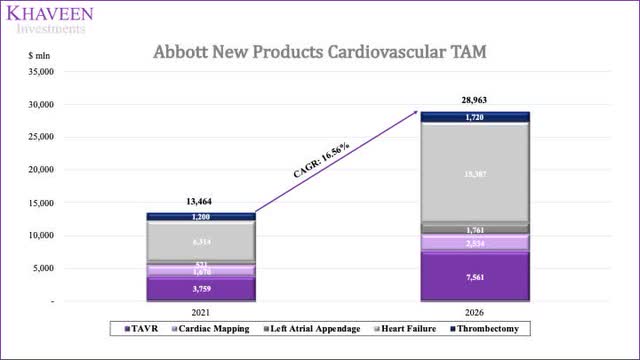

Abbott also received regulatory approval for its Transcatheter Aortic Valve Replacement (TAVR) system in Europe with its Navitor system and in the US with its Portico with FlexNav system. TAVR is used to treat patients with a high risk of open-heart surgery. The procedure is performed only on the elderly population as the long-term reliability of the product is yet to be determined. Additionally, Abbott acquired Walk Vascular in 2021 which provides the company with its less invasive thrombectomy system. Based on these regulatory approvals and acquisition of Walk Vascular, we projected Abbott’s TAM for its new products within the cardiovascular market using market projections for each of the markets.

Source: GlobalData, MarketWatch, GMI Insights, Market Data Forecast

GlobalData, MarketWatch, GMI Insights, Market Data Forecast, Khaveen Investments

Overall, we believe Abbott’s TAM for its new products in the cardiovascular market could grow from $13 bln in 2021 to $29 bln by 2026 growing at a CAGR of 16.56% which is a significantly higher growth rate than the broader cardiovascular market which is forecasted to grow at only 6.9%. As such we believe Abbott is focusing on the high growth markets within the cardiovascular market.

We forecasted Abbott’s cardiovascular revenues based on the various markets it operates in. We maintained the market projections from our previous coverage as the company has more products within each of these segments besides the ones that got regulatory approval in the past year.

Cardiovascular Business

2021

2022F

2023F

2024F

2025F

2026F

Rhythm Management

2,198

2,363

2,540

2,731

2,935

3,156

Growth (%)

14.84%

7.50%

7.50%

7.50%

7.50%

7.50%

Electrophysiology

1,907

2,082

2,274

2,483

2,712

2,961

Growth (%)

20.85%

9.20%

9.20%

9.20%

9.20%

9.20%

Heart Failure

889

1,062

1,270

1,517

1,813

2,166

Growth (%)

20.14%

19.50%

19.50%

19.50%

19.50%

19.50%

Vascular

2,654

2,869

3,101

3,353

3,624

3,918

Growth (%)

13.47%

8.10%

8.10%

8.10%

8.10%

8.10%

Structural Heart

1,610

1,774

1,955

2,155

2,374

2,617

Growth (%)

29.11%

10.20%

10.20%

10.20%

10.20%

10.20%

Total Cardiovascular Revenues

9,258

10,151

11,140

12,238

13,458

14,817

Growth (%)

18.42%

9.64%

9.75%

9.86%

9.97%

10.10%

Source: Abbott, Khaveen Investments

Launch of Virtual Clinic to Improve Market Share in Neurology Market

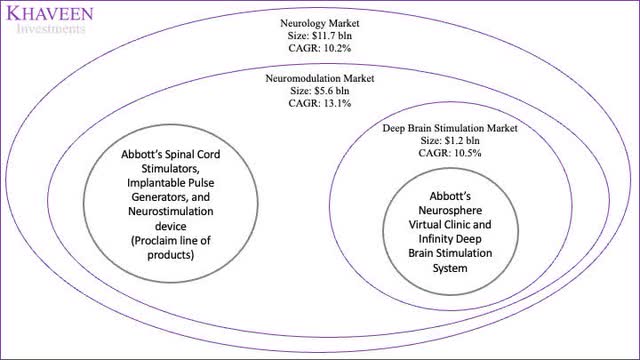

Abbott is also focusing on the Neurology market which is valued at $11.7 bln in 2021 and forecasted to grow at a CAGR of 10.2% by Market Research Future. Abbott launched the NeuroSphere Virtual Clinic in 2021 specifically catering to patients that undergo Deep Brain Stimulation (DBS) treatment. According to Lozano et al., there were more than 160,000 DBS patients globally in 2019 and the number of patients is expected to continue growing. In a study conducted by Zhang et al., the researchers highlight the DBS system can be used to treat a variety of neurological diseases such as Parkinson’s, Dystonia, Obsessive-Compulsive Disorder, and Epilepsy. Additionally, studies are being conducted to further expand the use of DBS systems to treat major depression, addiction, and Tourette syndrome as well. To better understand the market Abbott’s NeuroSphere Virtual Clinic addresses, we have provided a visual representation of the various markets within the Neurology market. Additionally, we have also shown the other products Abbott has within the market such as spinal cord stimulators, implantable pulse generators, and neurostimulation devices.

Abbott, Market Research Future, MarketWatch, Khaveen Investments

Other major players in the market are Medtronic and Boston Scientific (BSX). Additionally, smaller companies and startups such as LivaNova (LIVN), Synapse Biomedical, Nevro (NVRO), NeuroSigma, among others also compete in the neuromodulation market.

As the name suggests, the NeuroSphere Virtual Clinic is a new platform that allows patients to remotely communicate with their doctor specifically for DBS treatment. With Abbott’s new platform, doctors can treat patients remotely via Abbott’s app which connects to the device implanted in the patient. This is currently the only product in the market that allows doctors to remotely treat patients with DBS implants. This signifies a significant competitive advantage for Abbott as Parkinson’s Foundation claims patients currently travel 150 miles (241 km) on average to visit DBS specialists in the US. Additionally, we were not able to identify a similar system being developed by Abbott’s competitors, to communicate with their doctor specifically for the DBS treatment remotely hence, we believe this new system may help Abbott to continue growing its presence in the Neurology market.

We forecasted Abbott’s Neuromodulation business to grow at the market CAGR of 13.1%. We were unable to calculate the specific revenue contribution from NeuroSphere Virtual Clinic as it is a new venture of Abbott, and the company does not provide a breakdown of Neuromodulation revenues.

Abbott Neuromodulation

2021

2022F

2023F

2024F

2025F

2026F

Revenue ($ mln)

781

883

999

1,130

1,278

1,445

Growth (%)

11.25%

13.10%

13.10%

13.10%

13.10%

13.10%

Source: MarketWatch, Khaveen Investments

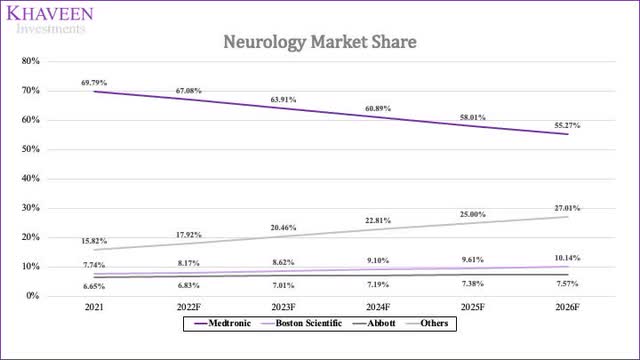

Based on this revenue projection, we believe Abbott may gain market share in the overall Neurology market from 6.65% to 7.57%. We obtained the forecasted market share of Medtronic and Boston Scientific based on our previous revenue projections for each of the companies. From our market share projections, we also observe the Other companies’ market share growing the fastest signaling there may be a lot of new entrants and innovation in the market while Medtronic the current market leader significantly declines in market share.

Company Annual Reports, Market Research Future, MarketWatch, Khaveen Investments

Risk: Negative Brand Image due to Contamination

In February 2022, the company faced issues with its Nutritional business as consumer complaints regarding contamination of products led the FDA to investigate the issue. The complaint stated traces of 2 bacteria, Salmonella Newport and Cronobacter sakazakii, contaminated products manufactured at a facility in Sturgis, Michigan. Abbott has voluntarily recalled the affected products and conducted tests across its manufacturing facilities to detect quality issues in the manufacturing process. Based on the company’s investigation, it appears to have identified Cronobacter sakazakii in non-product contact areas while Salmonella Newport has not been detected in the factory. The investigation is still ongoing, and the FDA is yet to conclude the investigation.

This issue also led to regulators in China issuing warnings against using Abbott produced Nutritional products. Analysts claim about $325 mln in annual revenue could be affected as a result of the alleged contamination of Nutritional products. While $325 mln only accounts for 0.75% of revenues in 2021, we believe the company facing such issues can harm the overall brand image of the company.

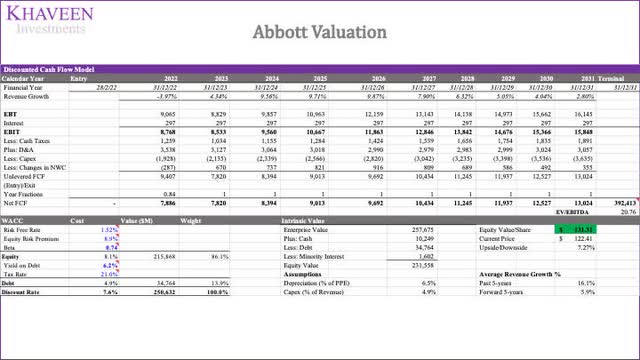

Valuation

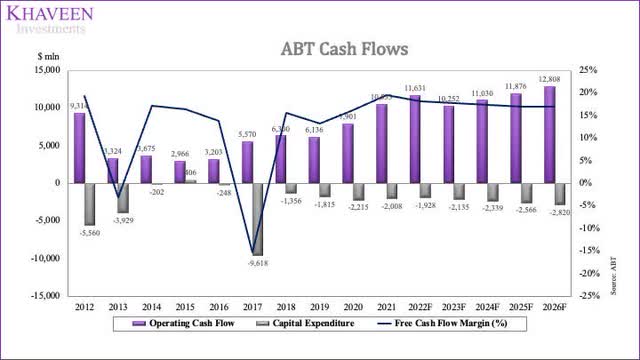

Abbott’s historical 5-year average FCF margin is 9.83%. The company has generated positive FCF expect in 2017 due to the acquisition of St. Jude Medical as mentioned above.

Abbott, Khaveen Investments

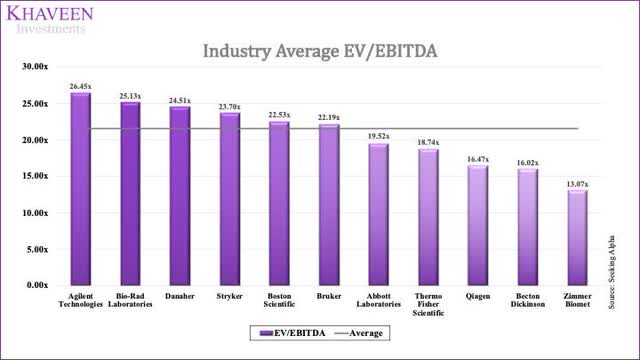

For our DCF model, we used an industry average EV/EBITDA multiple of 20.76x based on comparable companies as shown below.

Abbott, Seeking Alpha, Khaveen Investments

We projected Abbott’s revenues based on the various segments it operates in:

- Established Pharmaceuticals is forecasted to grow based on the market CAGR of 3.84%, projected by EvaluatePharma.

- We forecasted the Nutritionals segment growth based on the Grand View Research market CAGR forecast of 8.6%.

- The Diagnostics segment is forecasted to grow based on the market CAGR forecast for each of the individual businesses within the segment. Additionally, COVID-related revenue of $2.5 bln is factored into the segment for 2022 based on management guidance. From 2023 onwards, we expect the company to not obtain COVID-related revenue as management also believes a bulk of 2022 forecasted revenues to be obtained in the first half of the year.

- The Cardiovascular and Neuromodulation business is a part of the Medical Devices segment. Additionally, the company also recognizes Diabetes revenue in this segment which we forecasted to grow based on a market CAGR of 17.24% as discussed in our previous analysis.

Overall, we project Abbott’s forward 5-year average revenue growth rate to be 5.90%.

Segments ($ mln)

2021

2022F

2023F

2024F

2025F

2026F

Established Pharmaceuticals

4,718

4,899

5,087

5,283

5,485

5,696

Growth (%)

9.64%

3.84%

3.84%

3.84%

3.84%

3.84%

Nutritionals

8,294

9,007

9,782

10,623

11,537

12,529

Growth (%)

8.46%

8.60%

8.60%

8.60%

8.60%

8.60%

Diagnostics

15,644

11,300

10,154

10,991

11,898

12,883

Growth (%)

44.78%

-27.77%

-10.14%

8.24%

8.26%

8.27%

Medical Devices

14,367

16,108

18,088

20,342

22,913

25,849

Growth (%)

21.89%

12.12%

12.29%

12.46%

12.64%

12.81%

Other

52

50

47

45

43

41

Growth (%)

-21.21%

-4.50%

-4.50%

-4.50%

-4.50%

-4.50%

Total Revenues

43,075

41,365

43,159

47,284

51,877

56,999

Growth (%)

24.47%

-3.97%

4.34%

9.56%

9.71%

9.87%

Source: Abbott, EvaluatePharma, Grand View Research, Khaveen Investments

Based on a discount rate of 7.6% (the company’s WACC), we believe the company is currently fairly valued.

Khaveen Investments

Verdict

In conclusion, we believe the company’s geographic diversification of revenues helps maintain its position as a top player in the Healthcare Equipment industry however, to further differentiate itself from the top players, Abbott is focusing on growing its cardiovascular business. We believe the company is focusing on fast-growing markets within the cardiovascular market as we calculated the company’s new products TAM CAGR as 16.56% while the overall cardiovascular market is forecasted to grow at a CAGR of 6.9%. Furthermore, Abbott’s market share within the Neurology market is forecasted to increase by 0.92 percentage points by 2026 supported by the launch of its NeuroSphere Virtual Clinic. Overall, our DCF model shows the company is fairly valued, hence, we rate Abbott as a Hold with a target price of $131.85.