How to Sell on Amazon FBA Canada (Amazon.ca) in 2023

Updated in 2022 with up-to-date selling information for selling in Canada.

Are you looking to start selling on Amazon FBA Canada? If you’re a Canadian, Amazon.ca is arguably the best marketplace to start with. And if you’re from America or anywhere else who’s already selling on Amazon.com, Amazon.ca is an easy way to boost your sales by 10 to 20%.

In this guide, I’ll show you how to start selling on Amazon.ca, whether you’re a Canadian or non-Canadian.

Related Reading: How to Sell on Amazon.co.uk

Check Out Our FBA for Canadians Facebook Group

Are you a Canadian selling on Amazon? Check out our exclusive Facebook group for Canadian Amazon sellers.

Why Should You Sell on Amazon FBA Canada?

- Get around a 10% to 20% boost in sales

- Much less competition compared to Amazon.com

- Build up your listings and reviews now while the competition is weak.

- Allows you to ship products from Canada to Canadians from non-Amazon sources

- Simpler sales tax

Canada has about 10% of the population of the US so by this, you can expect at least a 10% sales boost for any one product by selling in Canada. For example, consider the Instapot shown below. According to Helium 10, it has sales of roughly $535,000 in Canada. In the United States, the sales are roughly $2.5 million for the same model. In other words, Canadian sales are roughly 20% of what they are in Canada.

The reason why many products punch above their weight in Canada (i.e., they get more sales than expected for a population of Canada’s size) is the fact that the competition in Canada is much less fierce. You can potentially easily rank a product on Amazon.ca that you might have no chance of ranking for on Amazon.com.

As Amazon.ca becomes more popular with Canadians, the competition will continue to increase. For this reason alone, I think if you have goals of one day expanding to Canada, now is the time to solidify your reviews and rankings in Canada and get a first-mover advantage.

One of the other benefits of selling on Amazon.ca is that you can use multi-channel fulfillment to ship Canadian orders from your website to Canadians direct from Canada (you cannot use MCF for international orders). This avoids duties and long transit times and is a big positive for Canadians.

Canada’s sales tax is also much more simple than many other regions (specifically Europe), and Amazon will collect federal sales tax for you in most cases (see more details in our sales tax section below).

What Is North America Remote Fulfillment and Should You Use It?

In 2019, Amazon rolled out something called North America Remote Fulfillment, otherwise known as NARF.

If you enroll in this program, it allows your Amazon.com products to show up on Amazon.ca, and Amazon will ship the products from America to Canada. Amazon will handle all aspects of shipping, taxes, and duties for you and charge them to the buyer. This is the downside with NARF – it adds extra costs to the customer and the shipping times to the customer are far longer than with inventory physically stored in Canada.

This program is excellent for those people who don’t want to actually go through the hassle of sending inventory directly into Canada. However, your sales can often be 90% lower or more when using NARF compared to physically sending inventory into Canada.

Read more about Amazon’s NARF program.

How to Add Your Amazon.com Listings to Amazon.ca

Because Amazon now has a Unified North American account, you can easily transfer your listings from Amazon.com and Amazon.ca, and yes, your reviews will transfer.

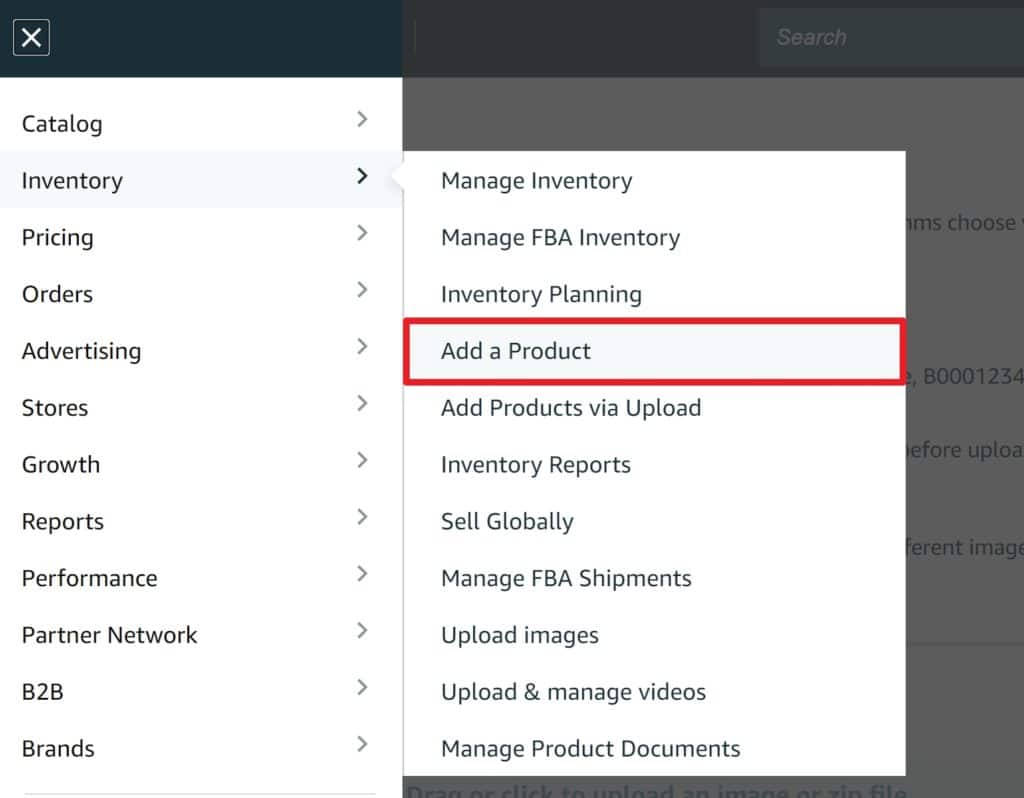

The easiest thing to do is to use the Add a Product option from the Inventory menu and add your existing ASIN.

By default, Amazon will preload your existing bullet points, descriptions, and images. You can edit your bullet points and descriptions if you want. However, if you change your images, these will be global unless you use the country-specific image upload manager here.

Popular Misconceptions About Americans Doing Business in Canada

Here are some of the things people mistakenly think about Americans selling to Canadians:

- You will have to pay Canadian income tax.

- Product regulations are different and more complex in Canada than in the United States.

- You will need to set up a Canadian bank account.

- Americans can work in Canada without a visa.

We are not accountants, but normally, the income you make in Canada will be exempt via tax treaty (assuming you have no permanent establishment in Canada). The reverse is true for Canadians doing business in the US. Check with an accountant to be sure of your tax liabilities though. However, you will definitely be subject to a sales tax liability once you surpass a certain sales threshold.

As for product safety requirements, labeling, etc., they are normally very similar to the US (as opposed to, for example, Europe, where they are much different). As always, though, check with a customs broker to be aware of any potential importing requirements before importing.

Canadian French Labeling Requirements

Canada has a significant French population, particularly in Quebec. By law, all mandatory label information should be shown in English and French except the dealer’s name and address. This normally includes the product name and net quantity/measurement information. Directions for use, and promotional/marketing statements do not have to appear in French.

This information is generally not checked upon import and, for better or worse, many private label sellers do not adhere to these labeling requirements.

For more information, see here: http://www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/01248.html

To sell on Amazon.ca, you can continue to use your American bank account and Amazon will simply convert the funds into US Dollars (normally with about a 3.5% commission). There’s no need to set up a Canadian bank account.

As an American, you cannot come to Canada to work without a Visa. There are certain activities you can perform in Canada for business, like visiting an accountant, visiting a client, etc. In other words, you can sell your goods on Amazon.ca and essentially pay good Canadian employees to ship your products, but you can’t open up your own warehouse and start shipping products yourself without getting the proper work visa.

Things to be Aware of When Selling on Amazon FBA Canada

- Amazon FBA fees may be higher in Canada.

- The exchange rate is volatile.

- Canadian duty rates are often higher than the US.

- No Amazon-partnered carriers are going to Canada

- You need a Business Number to formally import anything into Canada

- If sending UPS/FedEx etc. to Canada, make sure you send them DDP (Delivered Duty Paid) otherwise, Amazon will reject the shipment

- Canada has a federal sales tax (GST)

As you’re trying to calculate your potential profitability in Canada, remember that Canadian FBA fees may be higher, depending on the products (especially smaller and lighter items). Make sure to calculate your Amazon FBA fees when deciding your list prices in Canada – don’t just assume the Amazon.ca FBA fees are the same as Amazon.com.

You can more or less charge the price you charge on Amazon.com, converted to Canadian dollars, of course. In fact, you might even be able to charge more. However, the exchange rate is volatile. For example, in 2011 the Canadian dollar was actually worth more than an American dollar but in May 2020, a single Canadian dollar is worth about $0.70US. You want to keep an eye on the exchange rate, if not monthly, then at least quarterly. We adjust our prices many times throughout the year to reflect changes in the exchange rate.

Canadian duty rates also tend to be 25 to 50 percent higher than in the US (ignoring the 2018 China-U.S. trade war).

If you import goods from China into the US and then re-export them to Canada, you have essentially double-paid duties for both Canada and the US (it’s technically possible to file to get your US duties back, but the paperwork is very pricy).

Pro-tip: The country of origin of your products never changes. For example, if you import a widget from China to the US and then import it into Canada, Canada still considers that widget “Made in China.”

Also, with Amazon, there are no partnered carriers for shipping your goods from the U.S. to Canada. You need to arrange shipping from the U.S. to Amazon.ca warehouses on your own.

You will also need what Canada calls a Business Number to formally import into Canada. It’s easy to file for though.

When you’re shipping to Amazon.ca FBA, you must make sure that all duties and taxes are paid prior to arriving at Amazon.ca. With UPS and FedEx, you can ship via “DDP” (Delivered Duty Paid) which will basically have these charges passed on to you and keep Amazon from rejecting your shipment.

Sales Tax and GST/HST

Canada has a federal sales tax that is called GST/HST. Compared to the US, it is extremely simple. Each province sets its GST/HST rate (there are only 13 provinces/territories) and you remit everything in one form.

Furthermore, on July 1, 2021, things got even simpler as Canada rolled out marketplace tax collection (MTC) rules which means Amazon will collect and remit GST/HST for any seller who is not registered for GST/HST.

To complicate things slightly, four provinces set their own provincial sales tax rules: Quebec, British Columbia, Manitoba, and Saskatchewan (however, Amazon now collects sales tax for Saskatchewan. so there are really only three provinces you need to consider).

Not registering will not affect your ability to import into Canada or sell on Amazon.ca, but you are supposed to collect these. Further, Quebec has a significant economic threshold of $30,000 that you may not exceed and Manitoba has a total population of less than 1.4 million. For better or worse, many international sellers never register to collect provincial sales tax.

5 Easy Steps to Get Started Selling on Amazon.ca

Here’s the easiest way to get started selling on Amazon.ca.

- Send a small shipment to Canada – get your feet wet; Work it up to Pallets.

- List your products on Amazon.ca.

- Turn on Sponsored Ads for Canada!

- Monitor the exchange rate every month.

- Register for GST/HST.

Amazon unified accounts for the USA, Canada, & Mexico

For North America, Amazon has what they call a unified account. This means that within one Seller Central account you can:

- Manage inventory through one interface

- Pay one Professional selling fee

- Have payments remitted to your local bank account (Amazon will convert the funds for you)

This is in contrast to selling in Europe, Japan, etc. where you will need to set up another separate seller central account for those countries.

Send a Small Shipment to Canada

As you probably did when you first started with Amazon.com FBA, you probably sent in a box or two of goods to test out FBA, and not a full 20′ container. The same goes for Amazon.ca. Send a box or two via UPS or FedEx to get your feet wet. The procedure is almost identical as sending to Amazon.com.

You will need to send your goods via UPS or FedEx or another service that allows you to be billed for any duties and taxes, also called DDP. Do not send via USPS. If you do Amazon will be asked to pay taxes when your product arrives and they will reject your shipment.

Pro-tip: In America, there is an $800 de minimis value (any orders less than this do not have to pay duties/taxes). In Canada, this de minimis value is just $40.

List Your Products on Amazon.ca

When you will need to select what inventory you want to list in Canada. Recently, Amazon has made it so that you can simply look up the Amazon.com ASIN in the “Add a Product” tool within Seller Central and all the listing data will be carried over.

Your reviews from Amazon.com will transfer over until you get your first review on Amazon.ca

There are also a few other settings like shipping that you need to set up for Amazon.ca but the whole process should only take a few minutes.

Turn on Sponsored Ads

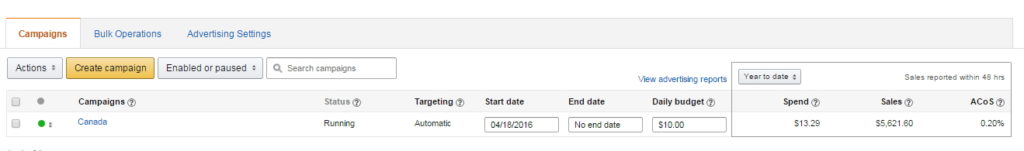

The first thing you should do once you get your inventory to FBA is start using Sponsored Products if you’re using them for Amazon.com. You will pay dramatically less than what you pay for Amazon.com (see our stats below – we’re paying just 0.2% ACoS!)

Monitor the Exchange Rate Every Month

When you price your products in Canada, you’re likely simply converting from U.S. dollars to Canadian dollars and maybe adding a bit of a cushion. Monitor this exchange rate on a quarterly or monthly basis as it will change and you should change your prices accordingly.

Setting Up a Canadian Business Number

If you’re sending goods up to Amazon.ca FBA via UPS or FedEx as a trial, you can likely avoid this requirement for your first couple of shipments. However, once you do any significant volume you need a business number.

If you’re sending anything that requires a customs broker to clear (i.e. you’re sending an LTL shipment) you will definitely need a Business Number. A business number is simply a number that you can use to collect/remit GST/HST and import goods into Canada. It’s similar to the U.S. EIN.

Registering for a Business Number in Canada is quite easy. You simply need to complete a form RC1. You can fax or mail it in (there’s no option to fill it out online) OR just call 1-800-959-5525 and a person will ask you all the questions on the phone and get you set up very quickly. Once you fill it in, you’ll be issued a Business Number within 10 days. When you register for this business number you can also get your GST/HST and Importer numbers – this is on the RC1 form you fill out. There are simply check boxes for each one.

Alternatively, your customs broker can register you for a business number for free or for a nominal fee (under $500). Pacific Customs Brokers can help you with this (let them know that EcomCrew sent you).

The form is self-explanatory and should take no more than 5-10 minutes (when it asks for a social insurance number, simply leave this blank). When it asks for your estimated taxable sales in Canada it’s wise to enter something below $100,000 as otherwise you will be required to prepay half of your estimated GST (The Canadian Revenue Agency will determine in your second year if you need to prepay a percentage of your GST/HST).

Pro-tip: If you want someone to set up your business number and help with your sales tax filings you can contact David at Small Biz Pro – he has a lot of familiarity with non-Canadian sellers on Amazon.ca and can help you get set up for those who don’t want to self-register.

Getting Liability Insurance When You Sell on Amazon.ca

No seller wants to be on the receiving end of a product liability lawsuit. No matter how small the chances are of your products malfunctioning or causing harm to customers, it is always wise to be prepared when it does happen.

Liability insurance can be expensive, but there are insurance providers like Foxquilt that give reasonable rates and personalized coverage, i.e., you only pay for the coverage you need. The application is also done completely online, so whether you’re selling in Canada, the United States, or both, you can be sure you have Amazon-compliant liability insurance.

Conclusion

Hopefully, this article has outlined my arguments for why you should be selling on Amazon.ca (as well as who shouldn’t be) and also how to get up and rolling. Since late 2015, Amazon.ca has been a significant driver of growth for my company and I think it can do the same for a lot of other companies seeking 10-20% sales growth.

Have you had any experience selling on Amazon.ca or other Amazon marketplaces? Do you have any questions about selling on Amazon.ca? If so, comment below.