How to Get a Black Card – American Express® Requirements – CardRates.com

If you’ve heard the buzz surrounding the American Express® “Black Card,” you already know that it’s the velvet rope of consumer credit options. This invite-only charge card, technically named the Centurion® Card from American Express, has been used to proclaim status, both in spending and in creditworthiness.

With all the hype, you may be wondering how to get a Black Card for yourself. But what is a Black Card? And what does it take to get an invite to this members-only club?

While we know that it’s an elite card used most often by celebrities and the ultra-rich, with the card itself being made of anodized titanium, less is known about exactly how to get your hands on one. That said, there are rumors of some rather strict requirements that must be met.

Invitation Only | For the Ultra-Rich | 10 “Easier to Get” Alternatives

Nội Dung Chính

Sorry, Black Cards Are By Invitation Only

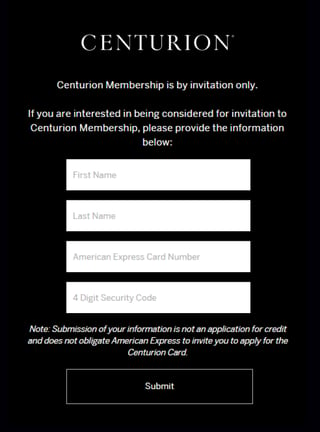

Like most elite experiences, the card is invite-only at the moment, with no indication that this will change anytime soon. Loyal American Express cardholders are likely the most commonly invited, a list that includes both long-time business and personal charge card customers.

Since there is no way to officially apply without an invite, your best bet is to check the requirements for members to see if your spending habits and qualifications match up. Most people realize that it’s not about knowing how to get a Black Card, but rather managing the very strict thresholds for eligibility.

If you’re the type to spend hundreds of thousands a year on a credit card, you can request consideration for an invitation directly from Amex.

This card offers unique perks for members, including access to airline lounges and VIP treatments at spas and hotels.

Black Card Requirements: For One, Be a Multi-Millionaire

Credit scores are one of the most important factors in getting a great credit card offer, and the Black Card is no different. The card, available to just 0.1% of the population, according to The Motley Fool, would most likely only be offered to those who can handle its spending power.

While the jury is out on what the exact cut-off is for a qualifying credit score, common sense would dictate that you must have an excellent credit score and established history of spending and payments with an existing American Express®= card to even be considered for this premium offer.

In the end, though, it’s mostly about how much you spend. The typical card user won’t be using their card in a way that meets Black Card requirements because most people don’t spend that much.

While it’s rumored that only cardholders of The Platinum Card® would have the credit lines available to push spending to the limits of qualifying for a Black Card, the purported $250,000 a year in purchases and payoffs required can likely come from any qualifying card.

No matter what card you use, however, it’s obvious that you need the income to both buy and repay a massive amount of goods and services to be Black Card material.

In addition to the high spending thresholds needed to be invited and maintain your status, there is a cost to join, as well. The initiation fee is $10,000 on top of a $5,000 annual fee. That means the perks you use must likely be high valued enough to make it worth the cost.

10 Black Card Alternatives

If you haven’t received a Black Card invitation and don’t happen to be a millionaire with a near-perfect credit score, that’s quite alright. There are many other cards that offer robust credit lines, awesome rewards, and other great features for the rest of us.

Here are our favorite alternatives to the Black Card, along with links to each card’s online application:

1. Chase Sapphire Reserve®

at Chase’ssecure website

EXCELLENT CREDIT RATING

★★★★★

4.7

OVERALL RATING

Our Review »

4.7/5.0

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Ultimate Rewards®

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Ultimate Rewards®. For example, 60,000 points are worth $900 toward travel

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

N/A

21.74% – 28.74% Variable

$550

Good/Excellent

2. The Platinum Card®

at the issuer’ssecure website

EXCELLENT CREDIT RATING

★★★★★

4.8

OVERALL RATING

Our Review »

4.7/5.0

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

N/A

20.49% – 27.49% Pay Over Time

$695

Excellent

3. Capital One Venture X Rewards Credit Card

EXCELLENT CREDIT RATING

★★★★★

4.7

OVERALL RATING

4.7/5.0

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive up to $300 back annually as statement credits for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

N/A

21.74% – 28.74% (Variable)

$395

Excellent

4. U.S. Bank Altitude® Reserve Visa Infinite® Card

at the issuer’ssecure website

EXCELLENT CREDIT RATING

★★★★★

4.7

OVERALL RATING

Our Review »

4.7/5.0

- Earn 50,000 bonus points worth $750 on travel when you spend $4,500 in the first 90 days of account opening.

- Earn 5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center.

- Earn 3X points for every $1 spent on eligible travel purchases and 3X points on eligible mobile wallet purchases

- Complimentary 12-month Priority Pass™ Select membership that gives access to more than 1,300 VIP lounges worldwide

- Get reimbursed up to $325 annual credits for eligible travel purchases and dining, takeout, and restaurant delivery purchases

- $400 Annual Fee

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

N/A

21.49% – 28.49% (Variable)

$400

Excellent

5. Luxury Card™ Mastercard® Black Card™

at Barclays Bank’ssecure website

EXCELLENT CREDIT RATING

★★★★★

4.5

OVERALL RATING

Our Review »

4.5/5.0

- Patented black-PVD-coated metal card—weighing 22 grams.

- 2% value for airfare redemptions with no blackout dates or seat restrictions. 1.5% value for cash back redemptions. Earn one point for every one dollar spent.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry.

- Enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest limit. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—available by phone, email and live mobile chat. Around-the-clock service to help you save time and manage tasks big and small.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties.

- Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

19.74% Variable

$495 ($195 for each Authorized User added to the account)

Excellent

6. Chase Sapphire Preferred® Card

at Chase’ssecure website

EXCELLENT CREDIT RATING

★★★★★

4.7

OVERALL RATING

Our Review »

4.9/5.0

- Earn 80,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $1,000 when you redeem through Chase Ultimate Rewards®.

- Enjoy benefits such as 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, and 2x on all other travel purchases, and $50 annual Ultimate Rewards Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 80,000 points are worth $1,000 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

N/A

20.74% – 27.74% Variable

$95

Good/Excellent

7. Capital One Venture Rewards Credit Card

EXCELLENT CREDIT RATING

★★★★★

4.8

OVERALL RATING

4.8/5.0

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Enjoy two complimentary visits per year to Capital One Lounges or to 100+ Plaza Premium Lounges through the Partner Lounge Network

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

N/A

20.74% – 28.74% (Variable)

$95

Excellent, Good

8. American Express® Gold Card

at the issuer’ssecure website

EXCELLENT CREDIT RATING

★★★★★

4.8

OVERALL RATING

Our Review »

4.8/5.0

- Earn 60,000 Membership Rewards® points after you spend $4,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the Gold Card at Grubhub, Seamless, Boxed and other participating partners. This can be an annual savings of up to $120. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. A minimum 2-night stay is required.

- $250 Annual Fee

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

N/A

20.49% – 28.49% Pay Over Time

$250

Excellent

9. HSBC Elite Credit Card

at the issuer’ssecure website

EXCELLENT CREDIT RATING

★★★★★

4.7

OVERALL RATING

Our Review »

4.6/5.0

- Earn 50,000 Rewards Bonus Points worth $750 in airfare – when booked online through HSBC Travel – after spending $4,000 in the first 3 months of account opening

- You’ll earn 3X Rewards Points on new travel purchases – including airline, hotels, and car rentals — 2X Points on new dining purchases, and 1X Points on all other purchases

- Receive up to $400 in travel credits per year for all airfare, hotels, and car rentals booked through HSBC Travel

- You and one guest enjoy complimentary, unlimited access to 1,000+ airport lounges provided by LoungeKey™

- Take 3 rides per month and receive a $5 Lyft App credit

- An exclusive Luxury Thank You Gift when you reach $50,000, $75,000, and $100,000 in cumulative spend annually. Up to 3 Luxury gifts per year.

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

N/A

N/A

19.49% – 23.49% (Variable)

$395

Excellent

10. Chase Freedom Unlimited®

at Chase’ssecure website

EXCELLENT CREDIT RATING

★★★★★

4.9

OVERALL RATING

Our Review »

4.9/5.0

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Ultimate Rewards®, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on Chase travel purchased through Ultimate Rewards®, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 19.74% – 28.49%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

-

See application, terms and details.

Intro (Purchases)

Intro (Transfers)

Regular APR

Annual Fee

Credit Needed

0% Intro APR on Purchases 15 months

0% Intro APR on Balance Transfers 15 months

19.74% – 28.49% Variable

$0

Good/Excellent

+ See More Cards For Excellent Credit

Final Thoughts

For those wondering just how to get a Black Card, the answer is pretty obvious (and pricey!): spend often, and on big purchases, with the intent to pay back promptly. If you find that you don’t meet the posh requirements of the American Express® Centurion card, you may want to consider your alternatives.

VISA and Mastercard have their own cards with elite characteristics, and they may be more open to new recruits. Many of these alternatives offer appealing benefits and rewards that the average user will find very valuable.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.