Apple Wallet | Cash, Card, Deliveries

AppleInsider may earn an affiliate commission on purchases made through links on our site.

Apple wants to eliminate everything a person carries that isn’t an iPhone, and it is doing so with Apple Wallet. This app is home to an increasing number of digital platforms that replace physical goods like credit cards and keyrings.

The Apple Wallet primarily exists on the iPhone and Apple Watch, though subsets of its functionality can be found on iPad and Mac. Digital wallets are nothing new, but Apple’s approach to the concept offers deep ecosystem integration, extensive privacy, and family-sharing systems.

While we’re likely many years away from people being able to completely ditch their physical wallets or keys, Apple’s digital Wallet brings us that much closer to that eventuality.

Nội Dung Chính

Apple Pay

The first thing people think of when someone says “wallet” is “payment.” Apple’s Wallet app acts as a repository for credit and debit cards attached to a system called Apple Pay.

Apple Pay adds debit and credit cards to your iPhone

Users add cards to the Wallet by scanning them with the iPhone camera or manually entering details. After a handshake with the user’s bank, the card becomes available for contactless and online transactions.

Tap-to-pay register terminals, or other iPhones for merchants, accept Apple Pay through an NFC transaction. Everything is handled over secure communications using randomized tokens. No one gets the original card number.

Apple Pay is compatible with most major banks and cards across over 50 countries. The United States payment infrastructure isn’t quite as modern as other countries, so don’t expect Apple Pay to work at every retailer.

Apple Card

Apple turned its Apple Pay service into yet another opportunity for ecosystem lock-in with Apple Card. Users sign up for the credit card via Goldman Sachs and control their accounts via the Wallet app on an Apple device.

Apple Card is a credit card provided by Goldman Sachs

Apple Card is a standard credit card with a physical option made of titanium alloy. Users get cash back for using the card in specific ways — 1% on all physical card swipes, 2% on standard Apple Pay or online purchases, and 3% on select purchases.

The 3% cash back is considered a “bonus, ” and retail partners come and go from this perk. Apple products purchased from the Apple Store will always score a 3% cash back. Otherwise, partners like Nike, Panera Bread, and Walgreens can get the 3% for Apple Pay transactions as long as that partnership is active.

Cash back is automatically applied every day to the Apple Pay Cash or Apple Savings balance, depending on the user’s settings.

Apple Wallet acts as the control center for Apple Card. Users manage the Apple Card balance, device payment installments, statements, and more within the app. There is a web portal for managing Apple Card as well.

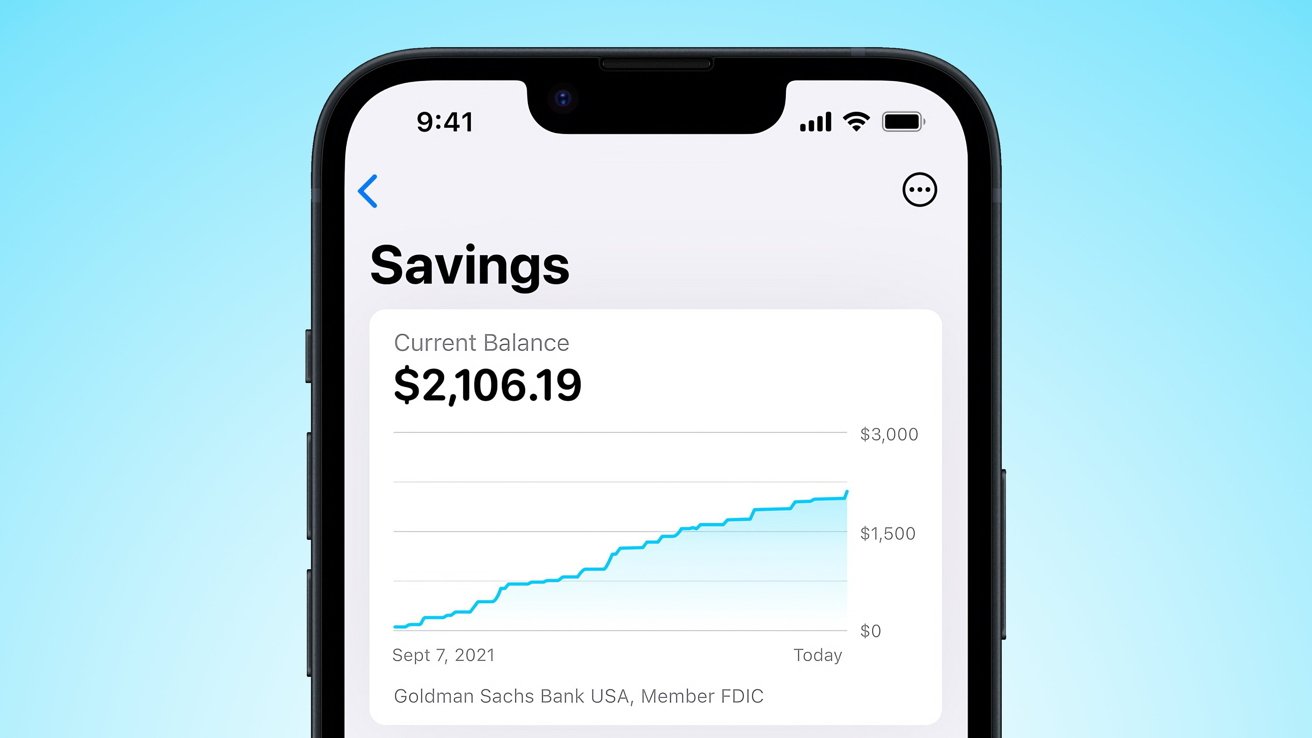

Apple Savings

Apple Card holders can apply for a free Apple Savings account that is also managed by Goldman Sachs. It appears within the Apple Card section of the Wallet app and can be managed from there.

Apple Savings grows at 4.15% (as of April 2023)

Users can deposit money from Apple Cash or direct from their primary bank account — if it’s authorized. Some users may have to go through additional steps with Apple support to prove an account belongs to them before being able to use it for Savings direct deposit or withdrawl.

Daily Cash can be added to the Apple Savings account automatically. All money in the Savings account will accrue interest at 4.15% APY.

Apple Pay Cash

Opposite Apple Card is Apple Pay Cash. It is a debit card operated by Green Dot bank.

Apple Pay Cash acts as a peer-to-peer payment service

Apple Pay Cash operates as a standard debit card as long as there is a balance to draw from. Money can be added via other Apple Pay debit cards, an attached bank account, or Apple Card Daily Cash.

It also acts as a peer-to-peer payment system. Users can send or receive money using iMessage or a transaction tool within the Apple Wallet app.

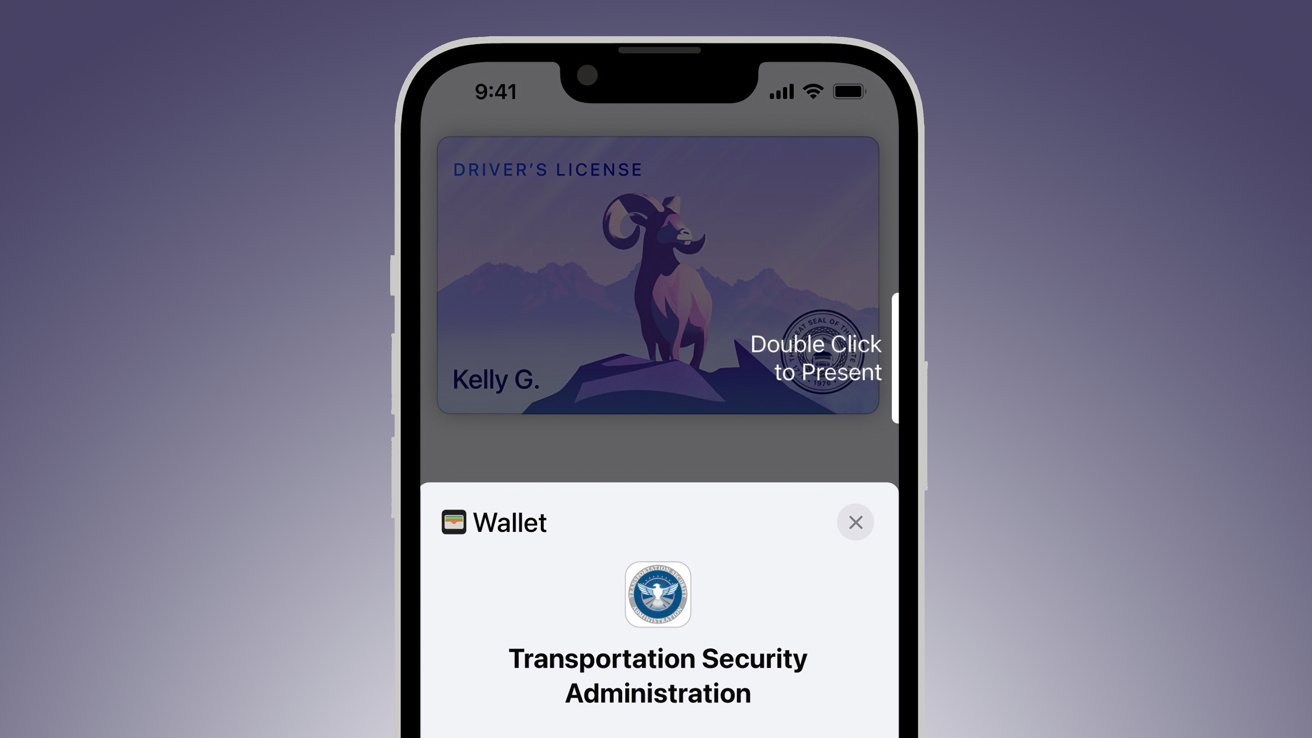

Identification

Apple offers an incredibly limited system for digital identification and state driver’s licenses. Currently, only residents in Maryland and Arizona have access to the feature, and it is only used for expedited TSA check-in at the airport.

Store state IDs for use at airports

The key feature of ID cards on iPhones is that they do not present any data on the device. It is a tap-to-present data feature, meaning users do not hand over their iPhones to show the ID.

At least 30 states are working on support for adding identification to Apple Wallet, though timelines for support aren’t clear. Also, there is minimal incentive for the feature since there is only one viable endpoint at select airports.

This is still very early days. Ultimately, Apple is expected to coordinate its digital ID systems for online age verification and even ID presentation for purchasing age-restricted items like alcohol. Much of this technology will be held up by state implementation and legislation.

Transit cards

Select transit cards can be added to the Apple Wallet app and used with a feature called Express Transit. There are three compatible cards in the United States, 28 cards listed for China, two for Japan, and one for Hong Kong.

Travel with ease using Express Transit

These cards are specifically compatible with Apple’s Transit Card feature and different from Wallet-compatible cards added from select transit apps. More are being added regularly, but transit infrastructure in the United States is lacking compared to other countries, so the technologies in use aren’t as modern.

Express Transit is a feature that lets users add specific cards for use without needing to authenticate via biometrics like Touch ID or Face ID. This means users can move through a turnstile without slowing down.

Cards used for Express Transit are also accessible even if the iPhone battery is depleted. This power reserve mode usually lasts about five hours after the battery needs charging.

Keys

Apple Wallet supports storing keys to a user’s home, car, hotel, school, or business. Express mode is used by default for keys.

Unlock Home Key-compatible doors with NFC

Keys for hotels are automatically added via an app interaction or similar on the hotel’s website. Business or school passes are handled by their respective organizations.

Adding a key to Apple Wallet provides a safe and secure method for access. Just tap the iPhone or Apple Watch to authenticate and gain entry.

Home Key is a specific kind of key stored in Apple Wallet shared from HomeKit. Users can purchase Home Key-compatible door locks for easy, secure NFC control.

Car Key is a system that is only available in select new vehicles. A limited number of vehicles use Car Key, and there are no known aftermarket systems for adding support.

Users can share Home Keys and Car Keys via iMessage with controls over how the key works for that individual. Shared keys can always be revoked by the user remotely.

Loyalty cards and tickets

One of the original uses for Apple’s Wallet app was storing customer loyalty cards, tickets, and passes. This legacy system is still available, with a few extra features thrown in.

Store loyalty cards in Apple Wallet

Apple has enabled retailers to automatically detect Apple Pay transactions and customer loyalty cards in a single tap. For example, rather than tapping a Walgreens card and then a payment card, the user can pay and have the loyalty card automatically applied.

Cards, tickets, and other types of passes can be added from an app and shown on the Lock Screen in certain situations. Like the Panera Bread loyalty card, which shows up if the user has provided location services to the app.

These types of cards can work with NFC but generally present a barcode for scanning instead.

Deliveries and receipts

Apple added a new delivery and receipt tracking system to Apple Wallet in iOS 16, iPadOS 16, and macOS Ventura. The receipt and other details are added to the Wallet app when a compatible purchase is made online or in person.

It is up to retailers to add support for this system. Some have promised support, like the major transaction and delivery tracking system called Shop.

Users can see a list of recent transactions, receipts for them, contact information for the merchant, and delivery tracking as applicable.

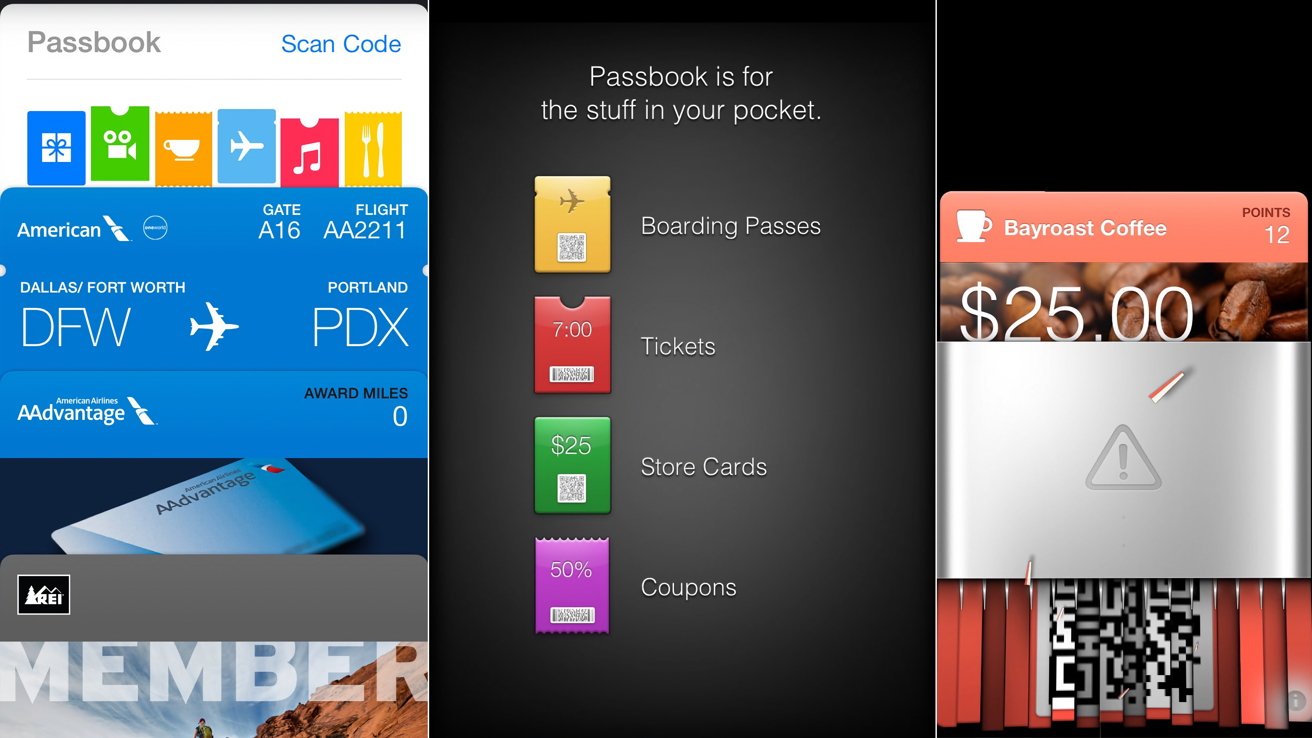

Apple Wallet history

Apple Wallet started life as the Apple Passbook, introduced at the 2012 WWDC and then released as part of iOS 6 later that year.

The Passbook, as the name suggests, originally stored passes, such as boarding passes, tickets to events, and loyalty cards.

Passbook used skeuomorphism to show off passes and tickets

Early in its existence, it also provided location-aware features, when it would display the appropriate pass or loyalty card at places it could be used. It was also possible for Passbook to alert users to last-minute travel changes, such as gate alterations or a flight delay.

The initial implementations revolved around using barcodes rather than wireless technologies like NFC.

In 2015, Apple renamed Passbook as Apple Wallet and added support for Apple Pay, extending the app’s usability into handling payment details. That year, NFC support was also added for loyalty cards.

By 2018, Apple had added support for contactless student IDs, which a number of universities used.

With the introduction of Car Key in iOS 14, the wallet enabled users to store a digital car key in their iPhone, which could then be used to operate a vehicle.

2019 saw the introduction of the Apple Card, a credit card for which users can sign up within the Wallet app and manage their accounts.

The 2021 update added more passes, home keys, and other credential types. Though announced in 2021, it wasn’t until 2022 that the app supported government-issued IDs.

Apple Wallet continues to evolve, with new features being added all the time. The deliveries and receipt system was added in late 2022.