Amazon PESTEL Analysis – Research-Methodology

PESTEL is a strategic analytical tool and the acronym stands for political, economic, social, technological, environmental and legal factors. Amazon PESTEL analysis involves the analysis of potential impact of these factors on the bottom line and long-term growth prospects of the e-commerce giant.

Political Factors in Amazon PESTEL Analysis

The range of political factors that affect Amazon include but not limited to the political stability or instability in the country, the influence of home market lobbying and pressure groups and the attitude of the government towards e-commerce and retail industries in particular. Additionally, the freedom of press, trade unions and their activities and the extent of corruption belong to the list of political factors with potential implications on Amazon business practices.

Due to the scope and scale of its business operations, Amazon plays an indirect role in politics in USA, Europe and some other regions. In other words, in markets where Amazon has a strong presence, the ruling government usually has a certain stance towards the e-commerce giant in particular among internet retailers.

Stance of governments towards Amazon

Most people either love or hate Amazon and this extends to politicians and government officials as well. Former US President Donald Trump was vocal in his dislike of the tech giant and sometimes criticised the company and its then CEO Jeff Bezos on Twitter. The current President Joe Biden also criticizes Amazon for paying low taxes and its opposition towards formation of labour unions. In February 2021 Biden “released the 2 ½-minute video. While he omitted the name of the powerful e-commerce giant, his remarks were seen as an unmistakable show of solidarity with a labour movement that failed to secure anything similar from his recent predecessors.”[1]

The company has hired the former press secretary of the US President, Jay Carney on February 2015 as a senior vice president of Worldwide Corporate Affairs to deal with the political issues that are impacting the business.[2]

Efforts of Governments on Cyber-Security

Increasing integration of internet and internet-based products and services into various aspects of personal and professional lives of people has prompted the emergence of cyber-crimes in various forms. At the same time, governments are fighting cyber-crimes through various measures, although the extent of range of measures employed and the extent of effectiveness of their application vary from country to country. Efforts of governments around the world to enhance cyber-security have positive implications on the performance of e-commerce companies such as Amazon through increasing consumer trust on online transactions.

Amazon Lobbying Practices

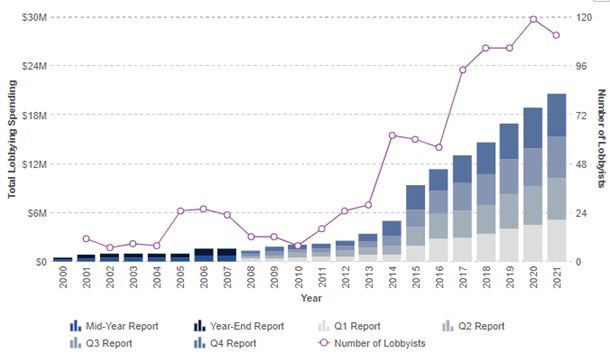

The tech giant engages in lobbying practices to attempt decrease the negative implications of political factor described above on the bottom line for the business. As it is illustrated in figure below, Amazon has been increasing its lobbying budget in the US for almost two decades with only a slight decrease in 2008. In 2021 The e-commerce giant spent more than USD 20 million attracting more than 80 lobbyists. The largest internet retailer in the world by revenue focuses its lobbying efforts on the whole range of policy issues including its tax battles, corporate tax reform, antitrust lawsuits and others.

Changes in annual lobbying budget in Amazon[3]

Economic Factors in Amazon PESTEL Analysis

There is a whole host of economic factors such as taxation and inflation rates, overall and industry-specific economic growth, unemployment levels and changes in currency exchange rates that directly affect the volume of revenues and growth prospects of Amazon.

Changes in Currency Exchange Rates

In 2021, net sales from international business accounted for more than 31% of Amazon consolidated revenues. Therefore, the business is subjected to currency exchange risks to a great extent. For example, if the U.S. Dollar weakens year-over-year relative to currencies in Amazon international locations, its consolidated net sales and operating expenses will be higher than if currencies had remained constant.

Likewise, if the U.S. Dollar strengthens year-over-year relative to currencies in Amazon international locations, its consolidated net sales and operating expenses will be lower than if currencies had remained constant. For instance, as a result of fluctuations in foreign exchange rates throughout the period compared to rates in effect the prior year, International segment net sales in Q2 2020 decreased by USD446 million in comparison with Q2 2019.[4]

Cost of Labour

Cost of labour is another important economic factor that affects the e-commerce and cloud computing company. Amazon is able to operate with razor-thin profit margin of about 7,1% due to saving in the costs of resources, including human resources. The median wages paid to 1,3 million Amazon employees equalled to USD 29,007 in 2020, an increase of only USD 159 compared to the previous year[5]. In contrast the median wages of Google and Facebook employees are USD 133,066 and USD 124,000 respectively.

Increase in the cost of labour is going to jeopardize the profit for the e-commerce giant with direct implications on the long-term growth of the business. Amazon senior management decided to adopt a proactive, rather than reactive approach towards external economic factor of cost of labour. Specifically, in 2018 the largest internet retailer in the world by revenue increased hourly wages of employees, including seasonal workers in US to USD 15,00.

Changes in Taxation

In June 2017, former US President Donald Trump spoke of a necessity to introduce ‘internet tax’, specifically referring to Amazon. Analysts noted that “one possibility is that Mr. Trump was thinking of a proposal to allow state governments to force internet retailers to collect sales taxes from their customers”[6]. As of March 2022, The largest internet retailer in the world by revenue started collecting sales tax nationwide. This instance can be referred to as an illustration of potential implications of economic factor, namely taxation on Amazon.

Amazon.com Inc. Report contains a full version of Amazon PESTEL analysis. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, Porter’s Five Forces, Value Chain analysis, Ansoff Matrix and McKinsey 7S Model on Amazon. Moreover, the report contains analyses of Amazon business strategy, leadership, organizational structure and organizational culture. The report also comprises discussions of Amazon marketing strategy, ecosystem and addresses issues of corporate social responsibility.

[1] Cadelago, C. & Rainey, R. (2021) “Inside Joe Biden’s decision to dive into the Amazon union drive” Politico, Available at: https://www.politico.com/news/2021/03/01/biden-amazon-union-video-472315

[2]Kusek, K. (2015) “Amazon Hires Ex-White House Spokesman Jay Carney” Forbes, Available at: http://www.forbes.com/sites/kathleenkusek/2015/02/26/bezos-hires-carney-former-white-house-spokesman-to-lead-amazon-corporate-affairs/#4f5b943133f6

[3] Open Secrets (2020) Available at: https://www.opensecrets.org/federal-lobbying/clients/summary?id=D000023883

[4] Quarterly Report for Q2, 2020, Amazon Inc.

[5] Dailey, N. (2021) “Amazon reveals how much it paid its median employee last year: USD29,007” Business Insider, Available at: https://www.businessinsider.com/amazon-employee-salary-pay-median-worker-compensation-compared-jeff-bezos-2021-4

[6] Cohen, P. (2017) “Trump, Amazon and ‘Internet Taxes’: What Did He Mean?” The New York Times, Available at: https://www.nytimes.com/2017/06/28/business/trump-internet-tax-amazon.html