Amazon Air’s new reliance on hub airports increases efficiency

Amazon’s in-house cargo airline is strategically concentrating more traffic at its Cincinnati hub and three regional bases while deemphasizing point-to-point flying, according to a report released on Tuesday that also showed it increased flight activity in the past six months despite economic headwinds.

Contract carriers such as Air Transport Services Group (NASDAQ: ATSG) and Cargojet (TSX: CJT) have recently warned they expect to fly less in 2023 because of the downturn in shipping demand and fewer flights required by their largest customers. Researchers at DePaul University’s Chaddick Institute for Metropolitan Development predicted Amazon (NASDAQ: AMZN) will continue to grow its air logistics but at a slower, single-digit annual rate compared to previous years.

“Our analysis, however, suggests that Amazon Air’s growth is driven primarily by a desire to accelerate its delivery options and protect market share amid mounting competition from both other online platforms and brick-and-mortar stores rolling out new conveniences. Although a recession could result in strategic shifts and a markedly reduced growth rate, we believe Amazon continues to have compelling reasons to expand its airline,” the report said.

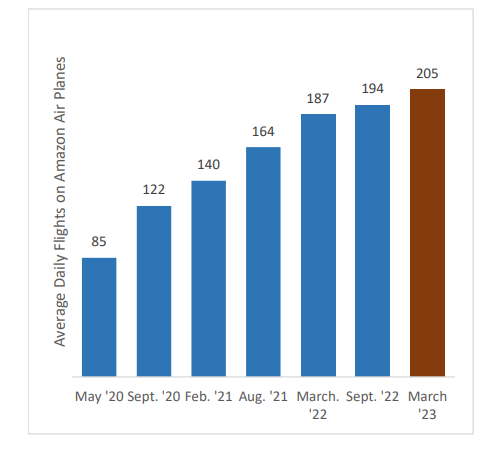

Amazon increased flight activity by nearly 6% since August and now operates 205 flights per day, up from 85 three years ago. It’s fleet has more than tripled during that time.

The DePaul team also said Amazon Air will significantly expand long-haul flying through its new partnership with Hawaiian Airlines, which is scheduled to begin flying the first of 10 Airbus A330-300 freighters in the second half of the year. And, they said, that capability will ultimately result in Amazon operating scheduled flights from Asia, hauling goods from origin directly to its warehouses.

Amazon Air hiked the number of flights at Cincinnati/Northern Kentucky International Airport (CVG) by nearly a third to 58 per day since September, according to the report. Over the past 12 months, takeoffs and landings at CVG are up 125%.

But the true number of daily flights to the $1.5 billion superhub is closer to 70 to 74 as Amazon increasingly utilizes non-branded planes under the control of partner airlines.

Amazon now clusters nearly all departures into two 90-minute banks in the early afternoon and early morning before 4 a.m., with arrivals streaming in several hours beforehand. The tight departure windows allow for efficient plane-to-plane transfers that support next-day delivery. About 17 to 18 planes leave together in the daytime. There are about a dozen overnight departures, with an additional half-dozen flights leaving from nearby Wilmington Air Park in Ohio. On some days, Amazon operates a short-hop flight 65 miles from CVG to Wilmington to transfer cargo to outbound planes, which generally serve Western destinations not connected to CVG.

As recently as a year ago most departures occurred midday and were spread out over several hours.

“Another relatively new feature is highly consistent daily flight itineraries. Flight patterns are quite predictable across the week, which likely helps simplify the retailer’s famously complex supply chain,” said the report, written by professor Joseph Schwieterman and two colleagues.

As arrivals become more tightly clustered to reduce time on the ground and increase fleet utilization, Amazon will be able to provide later cut-off times for shipments at distant airports, facilitating Amazon’s effort to move more extensively into third-party shipping, the report predicted.

How Amazon Air compares to FedEx, UPS

The reorientation of flights toward a hub-and-spoke arrangement increasingly resembles how FedEx (NYSE: FDX) and UPS (NYSE: UPS) structure their air networks.

Growth in daily Amazon Air flight activity. (Source: Chaddick Institute)

Growth in daily Amazon Air flight activity. (Source: Chaddick Institute)

CVG is still much smaller than the FedEx hub in Memphis, Tennessee, and UPS’ Worldport in Louisville, Kentucky, and Amazon planes still dwell much longer than at the express carrier hubs.

The increasing capacity at the CVG hub, which was inaugurated in September 2021, allows Amazon to offer next-day service on coast-to-coast moves and more third-party shipping service as an alternative to FedEx and UPS. But the online retailer still isn’t considered a fully integrated carrier because it only offers one-way delivery to consumers for companies that can stock inventory at several locations or need only two- or three-day delivery. Amazon doesn’t pick up packages or provide business-to-business delivery.

Amazon Air is gradually building up flight activity at three regional hubs: Fort Worth Alliance Airport in Texas; San Bernardino International Airport in California; and Lakeland, Florida. All three handled more flights during the past six months while other airports, including Baltimore and Portland, experienced declines. That’s a departure from a year ago when it appeared Amazon was trying to establish multiple mini-hubs and grow their traffic.

But outside the Ohio Valley, all Amazon Air hubs are geared toward daytime flights, suggesting they are less critical to overnight package delivery than the CVG/Wilmington complex, and more oriented toward inventory movement and deferred delivery, the report said. Daytime flights also complement Amazon’s huge trucking operation, which can move merchandise more cheaply than aircraft.

DePaul University’s Chaddick Institute uses flight tracking data and geographical imaging software to analyze Amazon’s air logistics network on a periodic basis.

The researchers determined that Amazon Air flights increased by 5.8% from August until March, up from the 3.8% increase in the previous six months. The growth rate is closer to 10% if “ghost” flights by partner airlines are included. Domestic flying only increased 2.8%. For the previous year as a whole, Amazon-branded aircraft increased utilization by 9.8%, down from 34% growth during the 12 months leading up to March 2022.

Amazon has been more cautious about growing the air network during the past year as e-commerce sales normalized and it postponed new warehouse expansions.

Amazon says its cargo airline has more than cargo jets, all of which are operated by contractors such as Air Transport International, ABX Air, Atlas Air and Sun Country. Most of the fleet consists of Boeing 767 medium-widebody and 737-800 standard cargo jets, with a handful of ATR72-500 turboprops flown by Silver Airways.

Fleet growth in excess of 200% since 2020 compares to 5.7% and 9.5%, respectively, at FedEx and UPS.

Amazon Air’s cubic volume of available cargo space is now between one-fourth and one-fifth the size of UPS and approximately one-seventh the size of FedEx. Its capacity as a share of those integrated logistics providers has more than doubled since March 2020.

Expansion at CVG accounted for most of the flight growth, but Amazon also added gateways in Boise, Idaho; San Jose, California; Mobile, Alabama; and Manchester, New Hampshire. Domestic takeoffs and landings not involving the CVG hub, however, fell 1.5%.

In January, Amazon Air launched service in India in partnership with third-party carrier Quikjet.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Cargojet to sell 777 aircraft, defer cargo conversions as demand slips

Amazon contractor ATSG expects cargo jet usage to dip 5% in 2023

Amazon, DHL reduce US cargo flights as parcel volumes soften

Amazon Air dials back air cargo expansion as e-commerce sales slow